{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “Why is the current cost of green hydrogen in the UK so high?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Because the sector is in its infancy. High CAPEX, expensive electricity inputs, and risk premiums push early prices above £200/MWh.”

}

},

{

“@type”: “Question”,

“name”: “Will green hydrogen be competitive with natural gas by 2030?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Not immediately, but with costs forecasted to fall below £100/MWh and rising carbon prices, hydrogen could become competitive in certain sectors.”

}

},

{

“@type”: “Question”,

“name”: “How does the UK compare internationally?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The UK’s early costs are similar to those in Europe, but global leaders such as the Middle East may achieve lower prices thanks to abundant cheap renewables.”

}

}

]

}

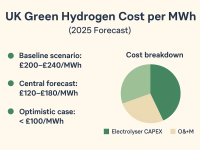

How Much Does Green Hydrogen Cost per MWh in the UK? (2025 Forecast)

Green hydrogen is often described as the “fuel of the future,” but in 2025 it is already a critical piece of the UK’s net-zero roadmap. From steelmaking to heavy transport, hydrogen is set to reshape industries. The key question is: what does green hydrogen cost per MWh in the UK in 2025, and where is the trend heading?

Current UK Cost Benchmarks

The UK Government’s first Hydrogen Allocation Round (HAR1), launched in 2023, revealed strike prices averaging £241 per MWh for green hydrogen projects. This figure reflects the high capital expenditure of electrolysers, elevated electricity costs, and the early-stage nature of the sector.

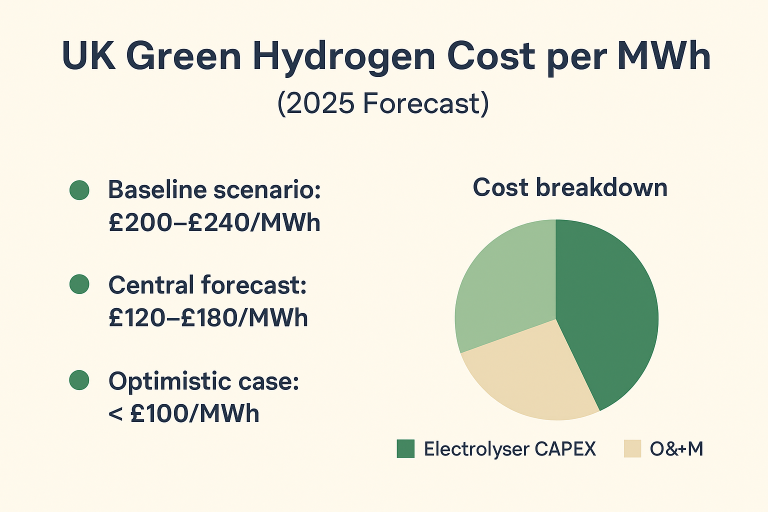

2025 Forecast — What Can We Expect?

- Baseline scenario: HAR1-style projects continue to operate near £200–£240/MWh.

- Central forecast: New projects in clusters with cheaper renewable electricity could achieve costs between £120–£180/MWh.

- Optimistic case: If policy reforms and supply chain efficiencies are fully implemented, costs could fall below £100/MWh, as targeted by RenewablesUK.

Why Costs May Decline

- Electricity sourcing: Renewable PPAs and co-location with offshore wind farms lower power costs.

- Electrolyser scale-up: As manufacturing capacity grows, per-unit costs decline.

- Policy reform: Measures proposed by RenewablesUK aim to cut costs through planning streamlining, flexible electrolyser operation, and grid access improvements.

- Learning effects: Early HAR1 projects provide operational data to optimise efficiency and lower financing risk.

Market Growth and Investment Outlook

The UK green hydrogen market is projected to expand from USD 0.74 billion in 2023 to USD 19.2 billion by 2033, at a CAGR of ~38.5%. This explosive growth suggests that cost reductions will accelerate as demand scales and supply chains mature.

Cost Conversion: £/MWh to £/kg

At £241/MWh, green hydrogen translates to:

- ~£9.50/kg (assuming ~39.4 kWh needed per kg).

- ~£12.00/kg (at a more conservative 50 kWh/kg).

If costs fall to £100/MWh, hydrogen could cost just £4–£5 per kg — a game-changer for industry adoption.

Implications for Industry and Policy

- Heavy industry: Lower hydrogen prices could make steel, cement, and chemical producers competitive in low-carbon exports.

- Transport: A sub-£5/kg hydrogen price could accelerate the rollout of hydrogen trucks, buses, and trains.

- Policy makers: Hitting the <£100/MWh target requires rapid action on grid reform, electrolyser deployment, and renewable integration.

- Investors: Early projects may lock in higher strike prices, but mid- to late-decade projects could enjoy much stronger margins.

FAQs

Why is the current cost of green hydrogen in the UK so high?

Because the sector is in its infancy. High CAPEX, expensive electricity inputs, and risk premiums push early prices above £200/MWh.

Will green hydrogen be competitive with natural gas by 2030?

Not immediately, but with costs forecasted to fall below £100/MWh and rising carbon prices, hydrogen could become competitive in certain sectors.

How does the UK compare internationally?

The UK’s early costs are similar to those in Europe, but global leaders such as the Middle East may achieve lower prices thanks to abundant cheap renewables.

Conclusion

In 2025, green hydrogen in the UK costs around £200–£240/MWh, but a path toward <£100/MWh is clearly in sight. With rapid market growth and policy support, the UK could soon deliver hydrogen at competitive costs — unlocking industrial decarbonisation and positioning itself as a European leader in the hydrogen economy.

0 Comments